Helping With Estate and Business Succession Planning

Free 15-minute consultation & book

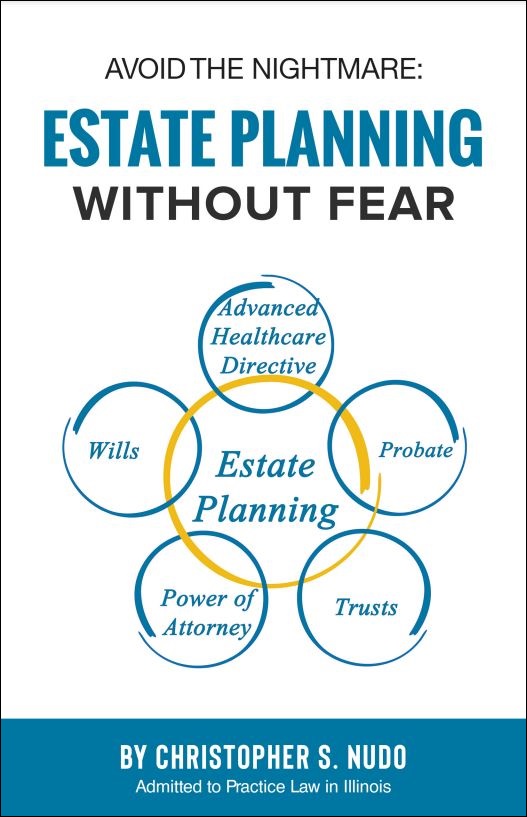

Estate Planning Without Fear!

I put this book together from the countless hours of helping thousands of families, which I have been privileged to serve over the last 30 years. It is remarkable that someone will spend hundreds of thousands of dollars on their home and other assets and not protect the succession of these valuable assets. If you take away one thing from this book, let it be that hiring an experienced lawyer to provide you with sound counsel and guidance is essential to ensure your wealth and legacy are properly protected.

What is Estate Planning and what is an Estate Plan? -

Estate Planning is the process of evaluating your assets (which is your estate) and identifying the best way to transfer those assets to the people you love when you die. The process also takes into consideration how your estate will be managed if you become incapacitated.

An Estate Plan is a set of particular documents that accomplish the goal of transferring your assets to the people you designate in the plan. The typical set of Estate Planning documents are:

- Living Trust

- Will

- Healthcare Power of Attorney

- Power of Attorney for Finances

One size does not fit all estates. It is important to analyze the estate size and value, family complexities, (such as young or disabled children), and your goals for your asset distribution at the time of your death.

Many people and couples could benefit from a living trust. -

A living trust should be the cornerstone of many estate plans. In simple terms, a living trust is a family agreement (like a contract), where a person or couple sets forth the terms in which they want their assets to go upon their deaths. This can be simple, such as everything to my surviving children in equal portions, all the way to complex distribution schemes. Complex estate plans assist with asset protection for the children, the creation of sub-trusts just for the children if they are too young to manage their inheritance appropriately, and setting guidelines for when people can get to the money in the trust. Some of the key elements of a trust are: a) avoids probate, b) the cost to administer is less than a will, c) terms of a trust are private, d) on average, the time to administer a trust is less than a will.

Distribution of the Estate and Minor Children. -

The most common estate plans leave the estate assets to surviving family members, such as children, grandchildren, parents, nieces, and nephews. It is also common for a portion of the estate to be left to a local church, charity or not-for-profit.

If you have minor children (under 18 years of age) or children that are young adults 18 to 30. Your estate plan should have protective measures in place to consider things such as:

- Guardians for your minor children

- Guidelines for how, when, and how much money your child can access.

- Protections for your young adults if they end up in a divorce, bankruptcy or if they don’t have good money management discipline.

- Guidelines for disabled children or young adults.

Estate and business succession planning. -

Estate and business successions tend to go hand-in-hand. Most entrepreneurial business owners overlook the need to plan for the succession of their business.

Your business is part of your estate. Often it is a large part of the estate. During the estate planning process, a business owner should discuss with an estate planning attorney how the business is structured, and how the owner would envision the sale or transfer of the business at the time of death.